The artificial intelligence industry has experienced unprecedented momentum in recent years, and one of the biggest winners of this wave is undoubtedly NVIDIA. Known for its graphics processors, the company is now not only a favorite among gamers and engineers, but has also become a central player in international technology strategies. Its shares are hitting historic highs on the US stock market, while more and more government cooperation and geopolitical threads are beginning to weave around it. But what does all this tell us about the future, and how well-founded is the current optimism?

Over the past few months, the value of NVIDIA's shares has increased by nearly two-thirds, which is remarkable in itself, especially given that the growth is due not only to technological innovations, but also to investor expectations and political decisions. Although US President Donald Trump's announcement of his tariff policy temporarily shook the stock market, the market quickly corrected itself, clearly confident in an imminent trade agreement. This confidence is crucial for a company whose future no longer depends solely on orders from tech companies.

NVIDIA's management also responded to the market situation in its own way: more than $1 billion worth of shares were sold from within the company over the past year. The company's CEO, Jensen Huang, also sold shares, although he did so based on a pre-scheduled sales plan that had been in place for months. While these transactions do not necessarily indicate a loss of confidence, they do paint a more nuanced picture of a company that attracts investors and enjoys political support.

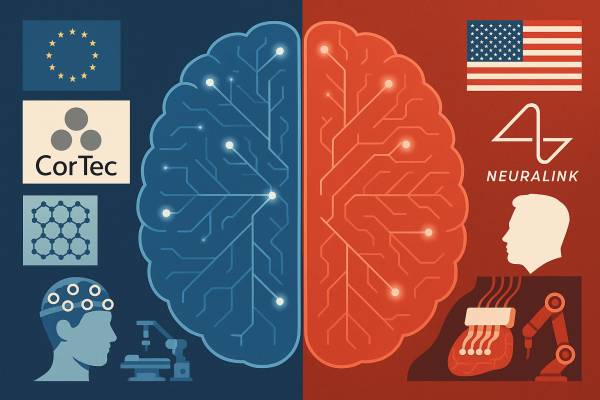

The key to future growth is now being sought in a little-known but increasingly important area: so-called “sovereign AI.” This concept refers to artificial intelligence infrastructure that is built and controlled by national governments rather than private companies. The idea attaches similar importance to AI systems as it does to energy or water supply, treating them as strategic national resources. NVIDIA is not just a supplier here, but a system builder, working with players such as Saudi Arabia's HUMAIN AI and Germany's Deutsche Telekom.

The nature and volume of these collaborations clearly show that the company has recognized that the traditional, Big Tech-dependent growth model cannot be sustained indefinitely. The willingness of large technology companies to invest appears to be stalling, especially in the area of AI infrastructure. In contrast, the government sector, especially in the Middle East and Europe, is now beginning to take AI development seriously. This could open up a new source of revenue for NVIDIA, but it also poses new challenges in terms of political and economic stability.

The equation is therefore more complex than it might seem at first glance. Behind the market euphoria lie realpolitik and business realignments that could have long-term consequences. Although NVIDIA has become one of the world's most valuable companies and its technological dominance is unquestionable at the moment, the stock sales taking place around it, global political movements, and questions about the sovereignty of AI infrastructures all show that the path of technological development is becoming less linear and increasingly dependent on the decisions of economic and political actors.

Artificial intelligence is no longer just a technological innovation, but a geopolitical tool and strategic investment. NVIDIA is not only a participant in this world, but also a shaping force. The question is not how long the current rise will last, but how well the company can balance market expectations and global political realities in the long term.