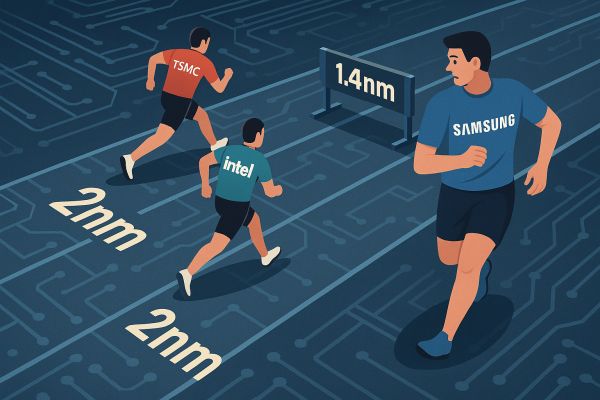

At the forefront of chipmaking, Samsung is making significant efforts to develop 2 nanometre Gate-All-Around (GAA) technology, which is key to the production of next-generation processors such as the Exynos 2600 and Snapdragon 8 Elite Gen 2. The South Korean giant aims to compete with market leader TSMC while facing a number of challenges, particularly in terms of manufacturing yields.

Issues around Exynos 2600 production

The Exynos 2600, Samsung's proprietary high-end chip, has already entered the mass production phase, according to the latest information. Although there were some difficulties during the initial trial production and yields were previously as low as 30 percent, Samsung is working intensively on this figure. Yield is a key metric used in chip manufacturing to express how many defect-free, usable chips are produced in a given manufacturing process compared to the total number of chips produced. The target was 50 per cent yield last month, and the long-term goal is 70 per cent, which is essential for cost-effective mass production. Samsung's LSI and foundry divisions have stepped up efforts to improve chip performance and increase production yields, minimising cost increases.

The Exynos 2600 is expected to go into production 2-3 months before the launch of the Galaxy S26 series in February. This timing is strategic as Samsung seeks to win large customers for its 2nm manufacturing process.

Competition for Qualcomm Snapdragon 8 Elite Gen 2 production

Samsung's 2 nm technology has also attracted Qualcomm's interest, particularly for its Snapdragon 8 Elite Gen 2 for Galaxy chip. Previous reports had suggested that Qualcomm had placed all its orders with TSMC for 3 nm technology, but the latest news is that Samsung is in talks with Qualcomm for 2 nm production of the Snapdragon 8 Elite Gen 2.

However, the challenges are significant as TSMC has gained a significant advantage in 2nm manufacturing. Samsung can currently produce 7,000 2nm silicon wafers per month, but low-volume production at its Hwaseong S3 plant means only 1,000 12-inch wafers per month.

Qualcomm has tried a dual sourcing strategy in the past, i.e. using both Samsung and TSMC technology to reduce its chip costs. However, this plan has not been implemented in the past due to Samsung's poor yields. Design work on the Snapdragon 8 Elite Gen 2 for Galaxy is expected to be completed in the second quarter of this year, with mass production preparations starting in the first quarter of 2026.

In summary, Samsung has set ambitious targets for 2nm GAA technology and is making significant progress in improving yields and launching mass production of the Exynos 2600. Winning Qualcomm orders would be key for the South Korean company, but competition with TSMC remains fierce. The next few months will be crucial to Samsung's ability to deliver on its hopes of being at the forefront of chipmaking.