In recent years, the small but essential microchips that form the foundation of almost all modern technological devices have increasingly come into focus. Supply chain disruptions, geopolitical tensions, and the race toward digitalization have prompted the European Union to seek greater autonomy in this strategic sector. Spain is aiming to play an ambitious role in this endeavor: not only does it want to participate in the growing European chip industry—it wants to lead it. But how realistic is this ambition? Or does the reality suggest that Spain’s role will remain limited?

Ambition vs. Reality

Spain makes no secret of its desire to become the European Union’s new chip hub. To achieve this goal, the Spanish government has launched the PERTE Chip program, which aims to attract more than €12 billion in investment across the entire semiconductor value chain, from design to manufacturing. This is a significant amount, even by European standards—especially considering that the total EU Chips Act budget stands at €43 billion. However, the key question is not just how much funding is available, but whether the country’s institutional and industrial background is capable of utilizing it effectively.

Recent developments paint a mixed picture. For example, U.S. company Broadcom withdrew its plans for a $1 billion facility in Spain, which would have been the only large-scale chip packaging plant in Europe. The cancellation of this project represents a major setback, as it would have created around 500 jobs and brought in valuable technological know-how that is scarce elsewhere in Europe.

Political and geopolitical factors were behind the project’s failure. Negotiations between the Spanish government and Broadcom dragged on for months, with no agreement reached regarding the plant’s location or investment terms. In contrast, other European countries such as Germany and France already have concrete projects underway, thanks to more targeted and responsive industrial policies.

Progress in Planning, Production Still Pending

Although large-scale manufacturing investments have yet to materialize, Spain has made notable progress in other areas. A joint €400 million research and development laboratory by Intel and the Barcelona Supercomputing Center (BSC) marks a significant advance in chip design and next-generation architectures (e.g., RISC-V) at a global level. The aim of the project is to develop zettascale computing systems—machines that surpass exascale performance by a factor of a thousand—which will be crucial in fields like artificial intelligence, autonomous vehicles, and scientific simulation.

In addition, the UK-based company ChipFlow has chosen Spain as the location for its new headquarters. While the company does not engage in manufacturing, it is active in chip design and the development of electronic design automation (EDA) tools. Its move sends a clear signal: Spain can be an attractive base for research and development, particularly thanks to EU subsidies and a highly skilled engineering workforce.

This trend—the clustering of R&D activity and companies—is encouraging. However, R&D alone is not enough for a country to become a semiconductor powerhouse. The most strategically critical segment of the chip industry is manufacturing—particularly front-end manufacturing, which involves wafer production. So far, Spain has shown limited activity in this domain.

International Comparison Provides Perspective

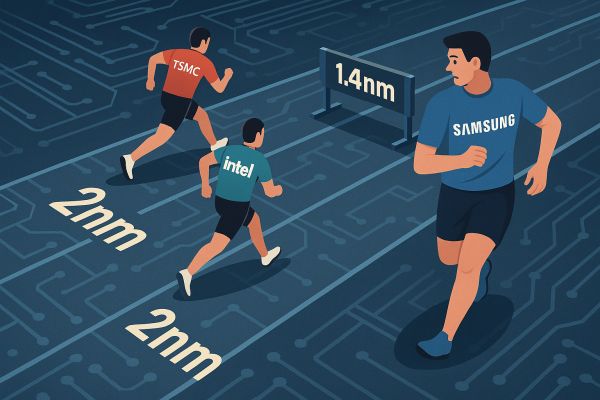

Within Europe, Germany is currently considered the epicenter of semiconductor manufacturing. Investments exceeding €48 billion are underway, including major plants by TSMC, Infineon, and Intel, primarily concentrated in the Dresden area—also known as “Silicon Saxony.” Both design and mass production are taking place there, with plans for further expansion.

Significant manufacturing projects are also in progress in France and Ireland, while Spain is seeking to carve out a niche in the design segment. This is not necessarily a disadvantage, as efficient manufacturing depends on robust design and architecture development. Still, if Spain truly aims to become a major player at the European or global level, expanding its manufacturing capacity will be essential.

Although Spain’s chip industry is growing rapidly, it is starting from a low base. According to market forecasts, the sector’s revenue was just €56 million in 2023 and is expected to reach €140 million by 2028. While this growth indicates strong momentum, the absolute figures remain modest by European standards.

Opportunities and Risks Ahead

Given the current outlook, it is unlikely that Spain will become the center of chip manufacturing in Europe—or globally—in the near term. However, the country could still establish itself as a leader in research and design, especially if it succeeds in simplifying administrative procedures and making the business environment more attractive to manufacturing firms.

The Broadcom case serves as a cautionary tale: even well-funded players are hesitant to commit to long-term manufacturing investments in Spain. Unless the country addresses its shortcomings in political coordination and permitting processes, others—like Germany, France, or even Poland—could easily capture the next major project.

At the same time, global demand for chips continues to grow, and the diversification of global supply chains remains a high priority. In this context, Spain still has an opportunity: if it steadily builds its ecosystem in line with its strategic goals, it could yet become a key player in semiconductor manufacturing.

Final Thoughts

Spain’s ambitions are undoubtedly serious, and the PERTE Chip program does offer the potential to bring the country closer to the major players in the semiconductor industry—at least in the area of research and development. But to become not only a home for chip designers but also a true manufacturing hub, Spain will need to implement significant institutional and structural reforms.

The key to success lies not in grand promises, but in consistent, flexible, and effective execution.