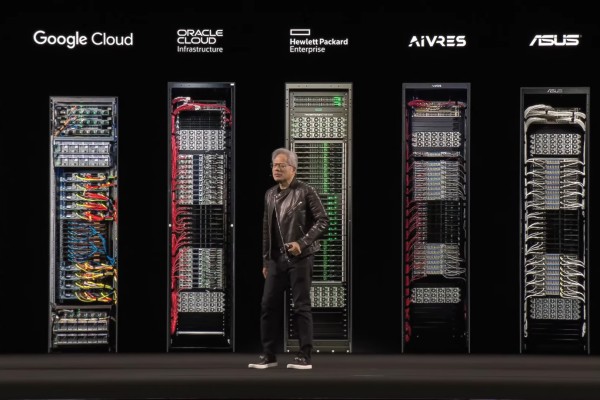

NVIDIA, the leading manufacturer of artificial intelligence (AI) chips, is adjusting its financial forecasts to account for continued uncertainty surrounding U.S. export restrictions impacting sales in China. According to CEO Jensen Huang, future financial projections will no longer factor in revenue from the Chinese market.

The restrictions are part of a broader effort by the U.S. government to limit China’s advancements in AI technology and prevent potential military applications. These controls have significantly impacted NVIDIA's operations, particularly as the company is a dominant player in the high-end AI chip sector.

Recent adjustments to U.S. export regulations have further restricted shipments of NVIDIA’s custom H20 chips, specifically designed for the Chinese market. This has led to the complete exclusion of China-related revenue from future financial forecasts. Jensen Huang expressed skepticism regarding potential negotiations between the U.S. and China that could ease these restrictions.

To navigate the evolving regulatory landscape, NVIDIA previously introduced a modified version of its AI chip, the H20, offering reduced performance compared to its flagship H100 model. Shipments began in early 2024. However, subsequent tightening of U.S. export controls in April required licensing for these shipments, resulting in substantial financial setbacks – approximately $2.5 billion in losses during the first quarter and an additional $4.5 billion due to excess inventory.

Despite these challenges, strong demand from Chinese customers stockpiling before restrictions intensified led to significant H20 sales in the first quarter of 2024, contributing $4.6 billion to revenue and representing 12.5% of NVIDIA’s total quarterly income.

While some anticipate potential adjustments to export controls under a future administration – specifically mentioning a possible easing of restrictions on certain chip types – it is unlikely that the most advanced AI chips will be approved for export to China.

Despite the ongoing challenges, NVIDIA's stock price experienced a modest increase on June 12th, reflecting investor confidence and demonstrating a year-to-date gain of nearly 8%.