The global robotics industry is at an unprecedented turning point as China and the United States engage in increasingly intense competition for dominance in the field of humanoid robotics. This is more than just a technological rivalry—it represents a fundamental struggle for leadership in the next phase of industrial automation. As Elon Musk, CEO of Tesla, puts it, “We are number one, but Chinese companies occupy second and tenth place,” accurately reflecting deep concerns about Chinese manufacturing capabilities and their strategic position in the robotics sector.

Market Dynamics and Forecasts

The humanoid robotics market has outstanding growth potential, although forecasts from various research institutes differ significantly. Industry experts expect explosive growth over the next decade, with compound annual growth rate (CAGR) estimates ranging from 17.5% to 52.8%.

These differences reflect, on the one hand, the emerging and still immature nature of the market and, on the other hand, the fact that analysts use different methodological approaches. According to Grand View Research’s more conservative estimates, the global market for humanoid robots could reach $4.04 billion by 2030, while OpenPR’s more optimistic projections put the figure at $69.74 billion by 2032. Goldman Sachs Research has also significantly revised its earlier forecast upwards, raising its estimate for 2035 from $6 billion to $38 billion, citing rapid advances in artificial intelligence and decreasing manufacturing costs.

Looking at long-term trends, Morgan Stanley Research predicts that by 2050, China will have the largest number of humanoid robots, with an estimated 302.3 million, followed by the United States with 77.7 million. This significant disparity reflects the manufacturing capacity and domestic demand of both countries.

Market expansion is being driven by several interrelated factors:

-

Demographic pressure: Societies in developed countries are aging rapidly, creating an urgent need for assistive technologies. According to WHO projections, by 2030, one in six people worldwide will be 60 years of age or older. Japan is at the forefront of this trend: by 2025, a shortage of 380,000 professionals is expected, prompting the government to plan significant investments in robotic solutions for elderly care.

-

Labor shortage: There is a growing shortage of workers in manufacturing and logistics. Companies are showing increasing interest in humanoid robots, as these systems can perform dangerous, repetitive, or high-precision tasks, thereby alleviating the pressure caused by the lack of human labor.

-

Technological convergence: Advances in artificial intelligence, particularly large language models (LLMs), have dramatically increased the intelligence and usability of robots. Developments such as NVIDIA’s Isaac platform and Project GR00T are playing a key role in shaping the next generation of robotic systems.

While forecasts for market size and growth rates paint an increasingly optimistic picture of the future of humanoid robotics, it is worth examining the innovation and patent patterns behind this spectacular development. Technological dominance depends not only on production volumes or market presence but also on who shapes the fundamental technological standards and intellectual property rights within the global robotics ecosystem.

Patent Status and Innovation Indicators

China has now established itself as a dominant leader in the robotics patent race, reflecting a strategic shift in global innovation patterns. According to data from the Center for Security and Emerging Technology (CSET), China registered more than 25,000 robotics-related patents between 2005 and 2019—almost three times the 9,500 patents registered by the United States during the same period.

China’s patent portfolio reveals a clearly systematic and centrally directed innovation strategy, which can be attributed to several factors:

-

Government policies: The Made in China 2025 industrial policy program has identified robotics as a strategic sector and provides it with targeted support. The rise in Chinese patent activity is directly linked to government efforts to position the country as a dominant force in both the domestic and global robotics markets.

-

Institutional incentives: State-sponsored incentive schemes, such as tax breaks for companies that hold a certain number of robotics patents, have played a significant role in driving the surge in patent applications. These incentives have encouraged not only corporations but also universities and research institutes to become more active in the field.

-

Accelerating trends: Patenting activity saw a major spike in 2019, when China filed 5,400 robotics patents—accounting for 43% of the global total. In comparison, the United States registered only 2,100 patents that year, representing a 17% share.

The declining share of the United States can be partly attributed to structural challenges within the American intellectual property system. According to CSET’s analysis, the U.S. legal framework struggles to adapt to the unique characteristics of fast-evolving technologies such as artificial intelligence, 5G, and quantum computing—limiting the effectiveness of legal protection and enforcement for cutting-edge innovations.

Nevertheless, the United States continues to enjoy a significant qualitative edge in terms of the sophistication and commercial viability of its robotics patents. This is especially true in areas where artificial intelligence is integrated to enhance the intelligence, adaptability, and market appeal of robotic systems.

Having mapped the landscape of patent competition and innovation indicators, it is also worth examining the actual technological capabilities of the leading countries in the robotics race. Investments in research and development, computing capacity, and manufacturing infrastructure can create significant strategic advantages—especially in a competitive environment where innovation cycles are becoming increasingly rapid.

Technological Capabilities and Strategic Advantages

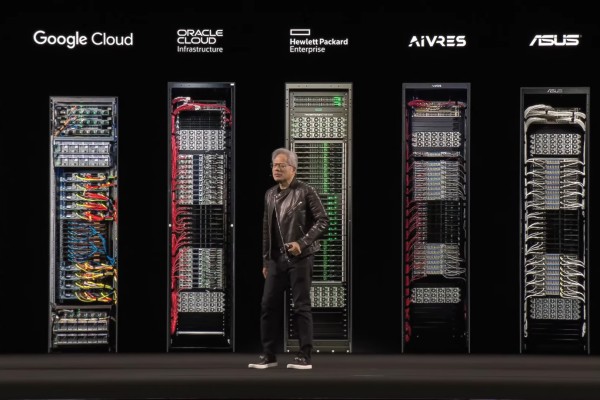

The United States currently holds a significant advantage in the fields of artificial intelligence and computing infrastructure that power robotics. At the core of this leadership are high-tech companies such as NVIDIA, Tesla, and other leading American AI developers, which are capable of delivering cutting-edge solutions for AI-robotics integration.

-

NVIDIA's robotics ecosystem: NVIDIA has developed comprehensive platforms such as Isaac Sim, Omniverse, and Cosmos, which offer a full development environment for robotics applications—from simulation to deployment. Project GR00T is a particularly noteworthy initiative, providing a general-purpose base model specifically designed for humanoid robots, fostering flexibility and scalability.

-

Advanced AI integration: The U.S. tech ecosystem is exceptionally strong in integrating large language models and generative AI into robotics applications. A prime example is Tesla’s use of its Grok language model in the Optimus humanoid robot, demonstrating the convergence of cutting-edge AI with the highest levels of physical automation.

-

Computing hardware advantage: NVIDIA’s dominance in the AI chip market provides a major competitive edge for U.S. companies. Processors like Jetson Orin and Thor, capable of delivering up to 150 TOPS of performance, are specifically optimized for robotics applications, enabling real-time decision-making and control.

In contrast, China’s technological strength is rooted in different types of strategic assets—primarily its manufacturing excellence and integrated supply chains. These capabilities enable the production of robotic systems that are faster to build, more affordable, and more broadly accessible.

-

Complete supply chain control: Chinese manufacturers benefit from the depth and complexity of their domestic industrial base. According to TrendForce, China possesses “complete supply chains” with “relatively low barriers to entry,” which significantly reduces dependence on foreign technologies and facilitates large-scale production.

-

Cost efficiency: Chinese companies operate with remarkable cost advantages. For instance, the Unitree G1 humanoid robot is available for just $16,000, dramatically expanding access to advanced robotics. This price point reflects China’s ability to rapidly achieve economies of scale.

-

Rapid iteration and testing: Chinese firms often adopt a strategy of continuous development and rapid prototyping. Products are frequently released in iterative cycles—sometimes with minimal pre-market testing—allowing companies to learn directly from real-world use and respond quickly to customer feedback.

Leading Players and Technological Challenges

Key players in the global humanoid robotics race—primarily American and Chinese companies—are making increasingly serious efforts to consolidate their positions in the industry. While the developments are impressive, significant technological hurdles still need to be overcome before large-scale commercial deployment becomes a reality.

American Players and Technological Promises

Several major U.S. companies are working on cutting-edge initiatives:

-

Tesla: The Optimus project is one of Elon Musk’s most ambitious ventures, aiming to produce up to 10,000 units by 2025. However, the program faces serious technical challenges: overheating motors, limited gripping force, and inadequate battery life continue to hinder mass production. Leadership changes—such as the departure of Milan Kovac—have further fueled uncertainty within the industry.

-

Boston Dynamics: The company remains at the forefront of dynamic motion and robotic mobility. Its fully electric Atlas robot demonstrates superhuman agility, but there are currently no plans for widespread commercial deployment.

-

Figure AI: A partnership with BMW Manufacturing marks the first major industrial deployment of humanoid robots. The company aims to integrate general-purpose humanoid robots into production line environments.

-

Agility Robotics: The Digit robot already serves as a commercial platform in warehouse environments. Agility also offers Agility Arc, a cloud-based fleet management system that supports scalable deployment.

Chinese Players and Rapid Manufacturing Capacity Building

China is moving rapidly toward commercial scaling and cost-effective mass production:

-

Unitree Robotics: Active in both quadruped and humanoid robotics, Unitree showcased its robots during the Chinese Spring Festival in front of more than a billion viewers. The H1 and G1 models offer affordable humanoid robotics, with prices starting around USD 16,000.

-

Emerging Players: According to TrendForce, at least six Chinese companies—including AgiBot, Galbot, Engine AI, and Leju Robotics—plan to produce thousands of humanoid robots by 2025, signaling the arrival of mass production.

Cross-Cutting Challenges in the Industry

Despite rapid progress, several technological barriers continue to limit meaningful breakthroughs:

-

AI maturity: Most current robotics platforms rely primarily on motion control algorithms. The general-purpose artificial intelligence required for complex, autonomous decision-making is still under development.

-

Safety and reliability: Safe operation in human environments demands extensive sensor systems, predictive algorithms, and long testing cycles.

-

Cost-functionality balance: The industry has yet to strike an optimal balance between advanced technical capabilities and cost-effective production—a key challenge for commercial scalability.

Summary

The global competition in humanoid robotics is unfolding in an extremely dynamic, yet still immature, technological landscape. The United States maintains a lead in artificial intelligence and computing power, while China offers a strong alternative through rapid manufacturing, cost efficiency, and vertically integrated supply chains. Patent activity, government incentives, and strategic partnerships suggest that both countries are aiming to secure long-term dominance in this emerging industry.

While humanoid robots are increasingly shifting from science fiction to reality, their commercial viability remains constrained by technological and system integration challenges. Achieving a true breakthrough will require not only advancements in hardware and software but also the development of a safe, reliable, and economically sustainable ecosystem.

Ultimately, the race is not just about building humanoid robots—but about who will be the first to deliver a functioning vision of the future.