In spring 2025, Huawei began mass shipments of its Ascend 910C artificial intelligence chip to customers in China. The company hopes to fill the gap left by U.S. export restrictions in the AI-chip market. The Ascend 910C is not a brand-new design: it combines two earlier Ascend 910B chips into one module, using Huawei’s own Da Vinci architecture and chiplet technology. This dual-chip design delivers about 780–800 TFLOPS of computing power and around 3.2 TB/s of memory bandwidth.

On the manufacturing side, the 910C follows a hybrid approach. It uses SMIC’s second-generation 7 nm (N+2) process together with 7 nm wafers from TSMC that were stockpiled before the U.S. sanctions of 2019. With power consumption near 310 W—slightly above the Nvidia H100’s 300 W—the 910C remains a competitive choice in terms of performance-per-watt.

In inference (model-running) tasks, the 910C shows its strengths. Independent tests find it reaches about 60 % of the H100’s inference speed, and dedicated CUNN-kernel optimizations can raise that share even further. However, its die-to-die bandwidth—tens of times lower than the H100’s—and a less mature ecosystem for large-scale model training mean that Nvidia’s top chips still offer more efficient training performance.

Huawei supports the Ascend 910C across several popular AI frameworks. In addition to its native MindSpore, it is compatible with TensorFlow and PyTorch. Special tools—like DeepSeek’s automated CUDA→CUNN converter—help teams switch from Nvidia hardware. This makes it easier for Chinese cloud providers and research labs to plug 910C chips into their existing workflows.

From a market viewpoint, the first 910C shipments arrived in April, with full-scale deliveries starting in May. By late 2025, Huawei expects to cover 60–70 % of China’s high-end AI-chip market. The company has reportedly ordered 1.4 million units at about USD 28 000 each, roughly the same price as the Nvidia H100.

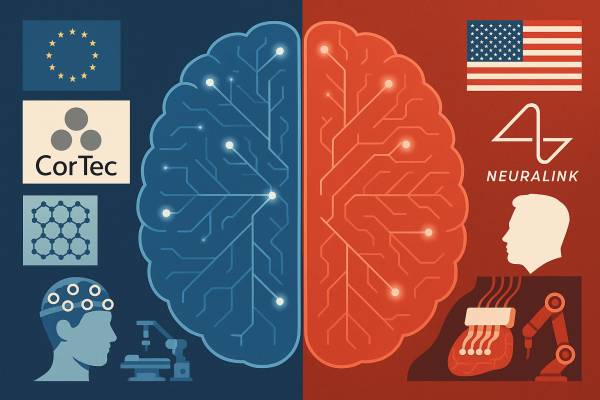

Geopolitical tensions and U.S. sanctions are pushing China’s semiconductor industry toward greater self-reliance. Rather than slowing domestic work, export controls have sped it up—forcing Chinese firms to lean on local suppliers. Over time, this could reduce dependence on Western technology.

Still, Nvidia’s global lead will not vanish overnight. H100 GPUs remain the standard for large-scale model training, and a quick shift away from Nvidia in the Western market seems unlikely. Yet the successful launch of the 910C shows how tech rivalry can split the global AI ecosystem into two branches: a Western, Nvidia-focused side and a Chinese, Huawei-based side. With the next-generation Ascend 920 already on the horizon, the AI-chip race is just beginning.